Jorge2221

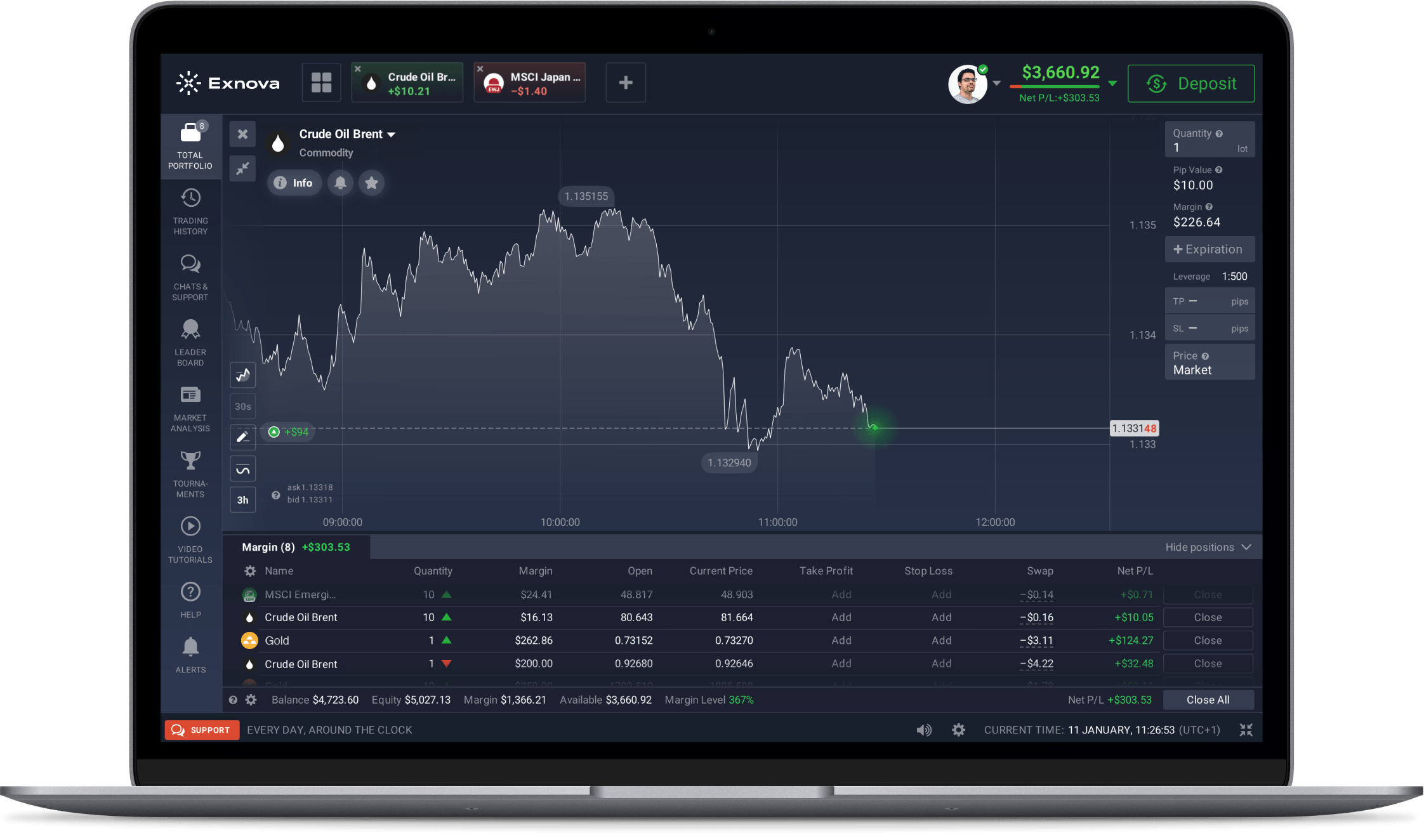

The app is fast and does not freeze even during active trading sessions. Everything is clear and understandable. I think you've done a great job on these 2 points: platform power and usability. Thanks for a great product!

December 12, 2021

DiogoVieira

Exnova is a great product! I use the platformalmost every day and I find it way easier than other providers. There's a mobile app that's awesome too.

January 6, 2022

Madsen_invest

I appreciate fair trading conditions, tight spreads and especially withdrawals via Payretailers. It would be cool to add more local payment systems, and then it would be perfect!

January 18, 2022

Oliveira88

Cool! There are many customizable indicators and widgets for different strategies. Educational videos helped me understand how things and saved me a lot of research time.

December 9, 2021

dannyofficial

Really great experience w/@exnova from day 1. I liked the clear interface and the interesting choice of assets. Additional tools and hints help make decisions faster, which is great!

December 24, 2021

amarianaferreiraaa

The platform is easy to navigate and has a decent choice of stocks. Commitment-free demo account and low initial deposit are good motivation for beginners. 10/10

January 28, 2022

DioneyFM

The app doesn't freeze or lag, convenient to use on the go.

January 11, 2022

vaibatatinha3348

Simple and good-looking customizable app without unnecessary buttons. Way to go 🤘🏼

December 3, 2021